r&d tax credit calculation uk

As a tax credit. Say our example SME made a loss of 300000 for the year with the same 100000 RD QE and chose to surrender losses and claim relief.

How To Calculate R D Tax Relief For Smes

How to Calculate RD Tax Credit for SMEs.

. First however the fix-based percentage must be obtained by dividing the QREs for tax years during a base period by the gross receipts from the same. Ad File VAT returns online using HMRC compatible software such as Xero. RD Tax Credits Explained.

It was increased to. Our highly-specialised friendly team will maximise your RD Claim. Ad File VAT returns online using HMRC compatible software such as Xero.

On this page you can calculate the value of your Research Development tax credits claim. Roughly how much does your company spend on RD per year. FInsights FInsights gives you industry leading white papers.

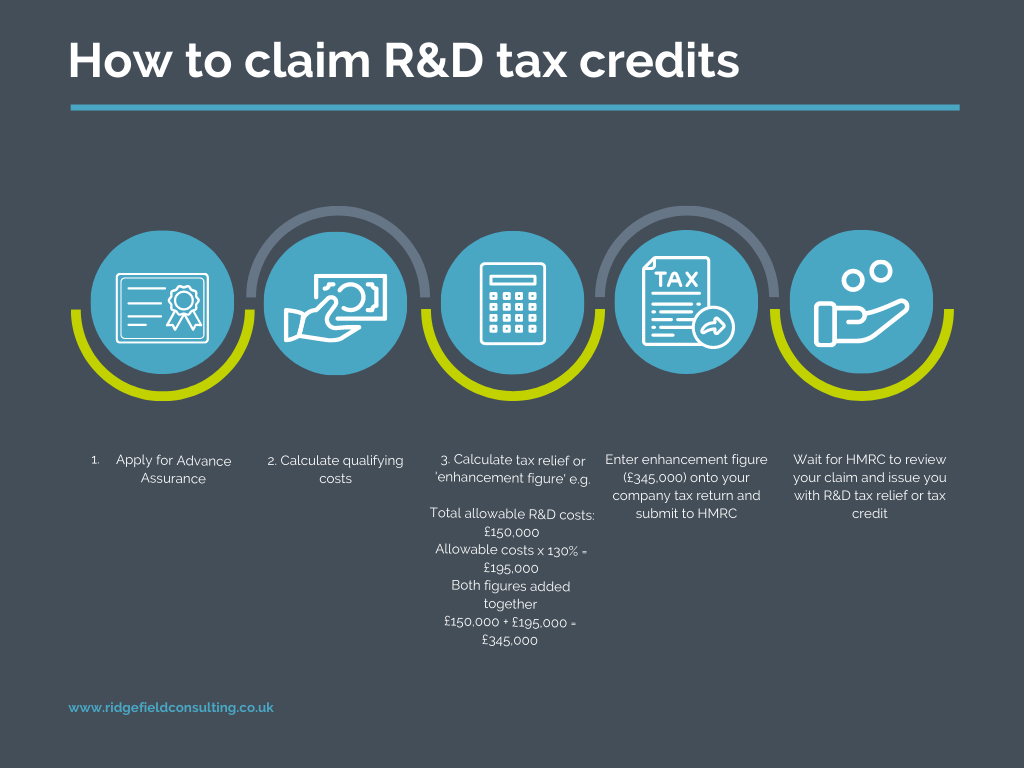

Rdvault R D Tax Credits Claim Calculator Free Estimate Pdf In 2min How to calculate the RD tax credit using the traditional method. Use HMRC-approved software such as Xero. The UK RD tax credit scheme offers UK companies a great opportunity to claim tax relief based on RD costs.

The rate at which businesses calculate their RD tax credit depends on whether they are making a profit or a loss. Officerndtaxcouk 181 Chorley New Rd. Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund.

RD Tax Credit Calculation Examples - The calculation of your RD tax relief benefit depends if your company is a Profitable SME Loss making SME or Large Regime RDEC. Ad Contact Us To Find Out How Your Business Can Take Advantage Of Tax Credit Incentives. Get Special Innovation Funds Tax Credits To Help Your Business Thrive.

Need Software for Making Tax Digital. Award winning RD Tax Consultants Claim RD Tax Credits. R D Tax Credit Calculator Our software engineers are busy creating a R D Tax Relief.

Im new to Claming. Tax benefits can vary between 8 - 33. Get Special Innovation Funds Tax Credits To Help Your Business Thrive.

Use HMRC-approved software such as Xero. Across all sectors the average amount reclaimed for our clients is 50000. Need Software for Making Tax Digital.

Rd tax credit calculator uk Tuesday October 18 2022 Edit. R. Ad Contact Us To Find Out How Your Business Can Take Advantage Of Tax Credit Incentives.

Maximise your R. Our free RD Tax Credit Calculator instantly crunches your numbers and shows how much in RD Tax Credits your business could claim from HMRC. The Research and Development Expenditure Credit is a tax credit it was 11 of your qualifying RD.

If you spend money creating or improving products or services youre probably eligible for an innovation tax refund. Rd report for Based on the information you provided it looks like we could help you claim back up to for. RD tax credit calculation using the traditional method is based on 20 of a companys current year QREs over a base amount.

Just follow the simple steps below. It was increased to. You Might Be Able To Turn That Tax Bill Into A Refund.

If you dont have all of your numbers to hand call our specialist consultants on 01332 819 740 or email. 100000 x 230 230000 uplifted qualifying expenditureRD tax losses 230000 x 145 33350 saving or refund. Most companies in the UK that claim RD tax relief fit into the SME category.

Call 01332 819 740. 12 from 1 January 2018 to 31 March 2020. RD Tax Credits Whether youre new to RD.

RD Tax Credits Calculator. Use HMRC-approved software such as Xero. Our RD tax credit calculator gives you an instant estimate of your potential RD tax credit claim just fill in the fields below.

Guidance on this can be found on our Which RD scheme is right for my company. The Research and Development Expenditure Credit is a tax credit it was 11 of your qualifying RD expenditure up to 31 December 2017. For a profit-making business an RD tax credit.

Use our RD tax credits calculator to get an indication of the cash benefit you can receive from claiming RD tax relief. Calculate how much your research and. Select either an SME or Large company.

R D Tax Credits Claim Portal Tax Cloud

How To Claim R D Tax Credits R D Accountants For Oxfordshire

R D Tax Credits A Guide To Eligibility Claim Preparation And Calculation

.png)

R D Tax Credits Explained In 2022 What Are R D Tax Credits Who Is Eligible

Research And Development R D Tax Relief M J Bushell

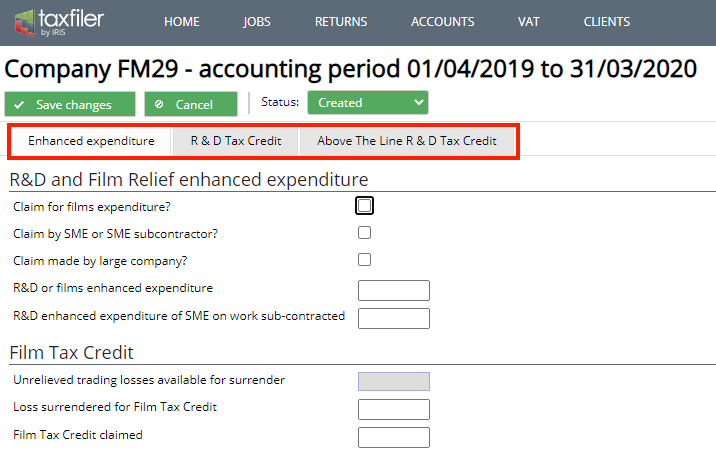

How To Enter Research And Development Claims

What Increased Audit Scrutiny Means For Your Uk R D Tax Claims

Rdec Scheme R D Expenditure Credit Explained

What S The R D Tax Credit Program Overview Cti

Klr Calculating The R D Tax Credit Rrc Vs Asc Method

R D Advance Funding Early Access To Your R D Tax Credit Mpa

We Look At The Definition Of R D Tax Credit For Uk Businesses

Rise In Claims For R D Tax Credits Amongst Smes Mpa

Research And Development Or Film Relief And Tax Credits Support Taxfiler

R D Tax Credits Explained Are You Eligible What Projects Qualify

R D Tax Credits 360 Research And Development

How Does The R D Tax Credit S Startup Provision Work Source Advisors